The Indian benchmark NIFTY50 saw a violent sell-off beginning the previous month. On the week ending October 5th, it also violated the 3-year old upward rising channel. Though, it has not started to give lower top and bottoms on the Weekly Chart; though presumably, it will do so this week, we try and examine where the Indian Equity Markets are placed globally and since some technical pullback has become overdue, which sectors Investors should look to in order to suffer less and subsequently out-perform the Markets at least on a relative basis.

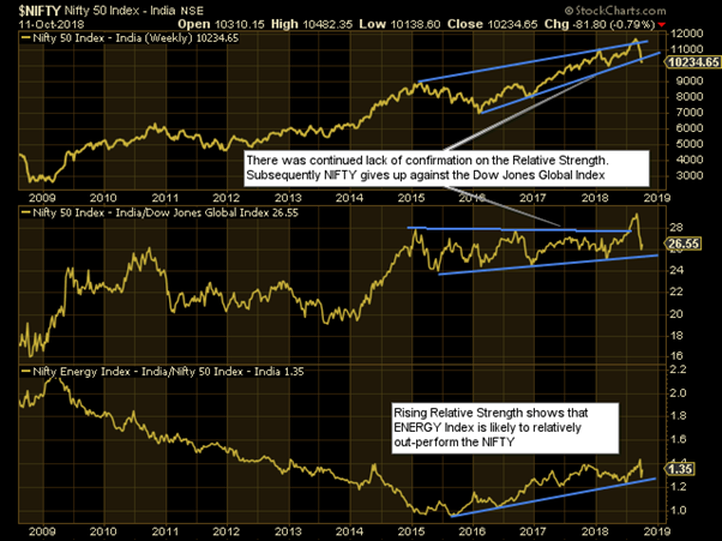

When we compare Indian NIFTY with Dow Jones Global Index, it is seen that the last couple of weeks of up move in NIFTY was not getting confirmed by the Relative Strength when compared against Dow Jones Global Index. There was persistent negative divergence with RS not confirming the NIFTY’s up move. Subsequently, NIFTY gave up and what we saw was a sharp corrective move in the domestic markets.

Now that NIFTY stands extremely oversold on the short-term charts and trades near its short-term support levels on Weekly Charts, there are a couple of sectors that Investors should find safe havens in. There are brighter chances that there will be a couple of sectors that will stand out when the long-overdue technical pullback occurs. These are also the sectors that are likely to relatively out-perform the general markets in event of continued volatility and weakness in the Markets.

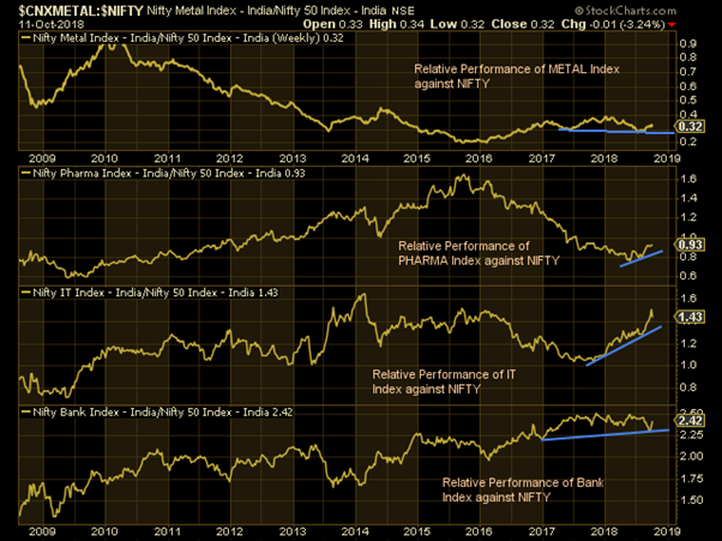

The above Chart along with the first one shows the Relative Strength (Relative Performance) of the Energy Index, the Metal Index, the Pharma Index, the IT Index, and the Bank Index against NIFTY. These have either not formed fresh lows and have shown bullish divergence, or they are distinctly seen inching higher.

In either of the situation, i.e. in a situation wherein an extremely long overdue technical pullback occurs or if the Markets continue to see a volatility situation with some weakness, these may be the sectors that Investors should choose to remain in. They may help them avoid losses or at least relatively out-perform the general markets as these sectors may offer resilient performance going ahead.

The complete picture of NIFTY placed globally subsequently the sectors on RRG (Relative Rotation Graph) can be seen HERE

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published