Among other tools and indicators that any technical analyst might use to analyze the price charts, they would also use a Breadth Indicator to measure the strength of the trend in the underlying security or an Index. In the event of any uptrend taking place in any security or an Index, it gets imperative to know if the uptrend has wider participation of stocks or if the uptrend is happening through the contribution of just a few stocks. For an uptrend to sustain and be healthy, it has to have a wider participation of as many stocks as possible.

Cumulative Advance-Decline Line is one such Breadth Indicator. The AD Line, as it is more popularly called, is based on Net Advances over Net Declines. It is calculated by deducting the Net Declining stocks from the Net Advancing stocks. Net Advances is positive when advances exceed declines and negative when declines exceed advances. The AD Line is a cumulative measure of Net Advances, rising when it is positive and falling when it is negative. This AD Line is used to measure the strength in the move; it has to confirm and move in tandem with the Index/Security.

One most important use of this AD Line Breadth Indicator is to examine any divergence; Bullish or Bearish, against the Index or the underlying Security. In the present case, this Breadth Indicator is shown a Bullish divergence against NIFTY 50 Index.

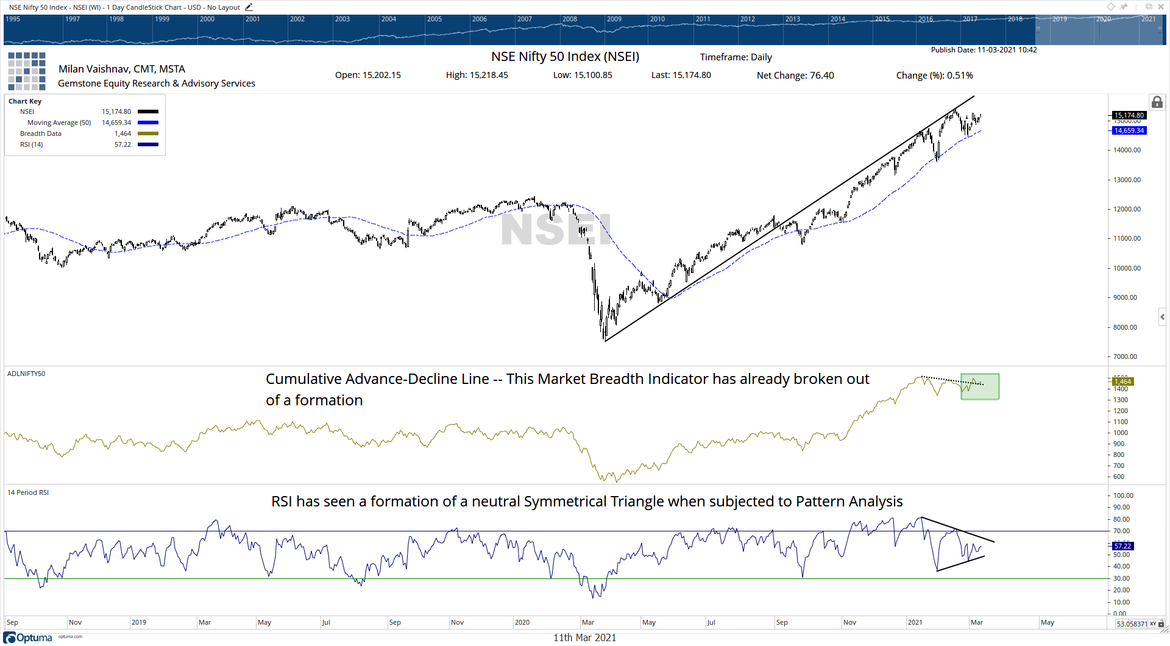

The one seen above is the NIFTY 50 Daily chart. To keep it free of clutter, it is plotted with only 50-DMA which is presently at 14659. Observe the extended trend line; it is drawn from the low point of last year and gets extended until today. The 50-DMA is almost acting as a proxy trend line on the lower side of the channel.

Below that is the cumulative Advance-Decline Line of NIFTY50. It has shown a Bullish divergence as the AD Line has moved out of a pattern and formed a new high ahead of the NIFTY. While the NIFTY is away from its high point, the AD Line hovers around its high point. It hints at possible higher levels for NIFTY and the increased likelihood of the Index attempting to retest its previous high point.

The RSI, which is a lead indicator can also be subjected to pattern analysis just like the price. It has formed a neutral Symmetrical Triangle formation. Any move out of this pattern is also set to offer us advance cues to the likely movement in the NIFTY over the coming days. However, as of now, the AD Line hints at possible higher levels for the NIFTY in the immediate short term unless the AD line starts heading down again.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published